2026 Star Ratings: What they mean and what comes next

With the Centers for Medicare & Medicaid Services (CMS) publishing the 2026 Star Ratings earlier this month, Medicare Advantage plans are looking to rapidly assess their performance and close care gaps before the calendar year ends. As measures and cut points continually evolve, understanding the nuances behind these ratings is critical for MA plans striving to deliver high-quality care and stay competitive in an increasingly difficult market. Here, we review the latest results, examine key measures and cut point impacts, and outline practical recommendations for boosting Star Ratings performance.

Reviewing the 2026 Star Ratings results

The latest ratings reveal relative stability in industry performance compared to previous years. In the 2026 ratings, just 4% of contracts earned five stars, 14% received four-and-a-half stars, and about 40% of contracts achieved four stars or higher—the critical threshold for qualifying for quality bonus payments. This percentage mirrors last year’s results, signaling stability after several years of decline. The average contract rating nudged upward from 3.63 to 3.65, a minimal change but indicative of consistent performance. Among Cotiviti’s Quality and Stars clients, 23% of contracts saw a year-over-year increase of at least half a star.

While the number of plans qualifying for bonus payments remains steady, individual contracts experienced movement: approximately 50 contracts lost their quality bonuses after ratings fell below four stars, while around 34 plans gained bonuses by meeting that threshold. Notably, 74% of plans that were above the four-star mark last year retained their status, underscoring the value of sustained, quality-focused operations.

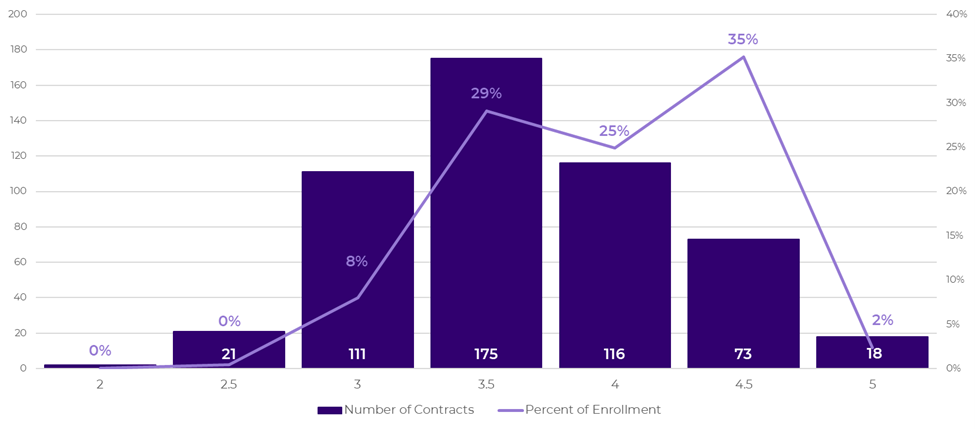

Enrollment trends also reinforce the importance of high ratings. In the 2026 ratings, 60% of Medicare members are enrolled in plans rated four stars or above, even though these contracts only represent 40% of the market (Figure 1). Among Cotiviti’s Quality and Stars clients, 5.8 million members are enrolled in plans rated four stars or above. This demonstrates how consumers gravitate toward higher-rated plans, validating the significance of the Star Ratings as a guide for plan selection.

Figure 1. Percent of enrollment at each Star Rating level (2026).

Key measures and the impact of cut points

Understanding cut points—the thresholds that determine star assignment for each measure—is essential for interpreting performance changes. For 2026, 57% of cut points increased, with approximately 60% of cut points at the two-, three-, and four-star levels increasing while only 45% of five-star cut points rose. This compression reduces the distance between performance tiers, making it both more challenging and more rewarding for plans to jump to the next star level with targeted improvement.

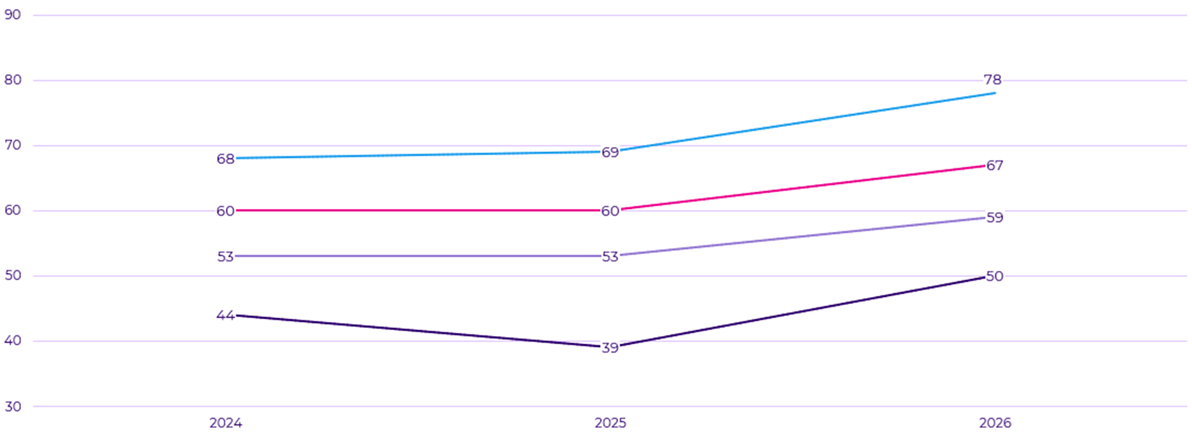

Several themes are driving these changes. First, newer measures without guardrails saw dramatic cut point increases, with cut points for Follow-Up after Emergency Department Visit (FMC) cumulatively jumping 33 points from 2025–2026 (Figure 2). As plans adapt to new criteria, cut points tend to rise sharply until operational practices stabilize. For established measures, the Tukey outlier deletion continues to compress the performance range. For example, without guardrails in place, the Diabetes – Blood Sugar Controlled (GSD) two-star cut point would have increased by 25 points instead of just five, demonstrating how removing outlier scores pushes overall cut points higher.

Figure 2. FMC cut point changes from 2024–2026.

The transition to digital measurement is also having a significant impact. With Colorectal Cancer Screening (COL) moving to ECDS reporting, cut points would have dropped by 23 points across all star levels without guardrails in place, reflecting the challenges plans face in demonstrating compliance as medical record review is eliminated. This transition significantly expands the performance range for affected measures, posing both risks and opportunities depending on a plan’s data integration readiness.

Key recommendations to improve performance

First, ensure your organization is well-informed about all upcoming program changes. CMS has added nine new measures over three years, each presenting a risk of underperformance if not proactively addressed. Plans should carefully set targets and anticipate large cut point increases in the early years of new measures.

Scenario modeling is a powerful tool for assessing potential impacts. By using scenario comparison tools, organizations can project how changes in cut points, measures, and methodology will affect their ratings, helping leaders prioritize resources and justify budget requests. Regularly review these models during planning cycles to avoid surprises and maintain focus on high-impact areas.

Prioritizing digital measurement transitions is critical. As more measures move to electronic data collection, plans should reduce dependency on chart review and strengthen electronic data capture processes. Analyze the loss of hybrid data collection now and develop a transition plan for remaining measures.

Finally, clean, complete, and timely data is a must-have for driving ROI and making informed decisions. Focus on interventions with the highest return, like member outreach and provider incentives, and regularly evaluate existing programs to ensure resources are allocated efficiently. Alignment with key stakeholders is also essential—star teams need to maintain cross-functional collaboration, educate internally on program changes, and align strategies to shared goals.

By embracing these recommendations, plans can position themselves for sustained success in the CMS Star Ratings program, delivering the best value to the members they serve and staying ahead in an increasingly competitive market.

Case Study: The journey to four stars

After several years of hovering around a three-star rating, one MA plan dropped to 2.5 stars. Instead of accepting this as the new normal, the organization made a bold decision to rethink its Star Ratings strategy with the help of Cotiviti’s Quality and Stars solutions, which support 44% of all MA contracts that received five stars this year.

Read our case study and learn more about the plan’s journey to Star Ratings transformation, including:

-

- Building a multi-year roadmap

- Real-time monitoring and collaboration

- Predictive cut points and scenario modeling