3 takeaways from the 2024 Star Ratings

As anticipated by the healthcare industry, the 2024 CMS Star Ratings released earlier this month demonstrated an overall decline in health plan performance for the second consecutive year. With several significant changes such as the implementation of the Tukey outlier deletion model and measure weight changes, the average rating for Medicare Advantage plans with prescription drug coverage (MA-PD) dropped from 4.14 to 4.04 when weighted by enrollment.

The following table demonstrates how the percentage of MA-PD contracts earning four stars or higher dropped from 51% for the 2023 Star Ratings to just 42% for the 2024 Star Ratings.

| Overall Rating | 2023 | 2024 | ||

|---|---|---|---|---|

| # of Contracts | Percentage | # of Contracts | Percentage | |

| 5 | 57 | 11.2% | 31 | 5.7% |

| 4.5 | 67 | 13.2% | 75 | 13.8% |

| 4 | 136 | 26.8% | 123 | 22.6% |

| 3.5 | 116 | 22.9% | 138 | 25.3% |

| 3 | 90 | 17.8% | 128 | 23.5% |

| 2.5 | 37 | 7.3% | 46 | 8.4% |

| 2 | 4 | 0.8% | 4 | 0.7% |

| Total rated contracts | 507 | 545 | ||

Figure 1. 2023 vs. 2024 Star Ratings performance. Source: CMS.

As noted by Cotiviti Senior Product Director Ashley McNairy in a recent interview with Healthcare Finance News, this continued decline in ratings partially stems from COVID-19-related policies that led to inflated ratings during the height of the pandemic. Longevity in the MA-PD market also was a significant factor, as noted by the Centers for Medicare & Medicaid Services (CMS) in a fact sheet:

Generally, higher overall Star Ratings are associated with contracts that have more experience in the MA program. MA-PDs with 10 or more years in the program are more likely to have 4 or more stars compared to contracts with less than 5 years in the program.

Here are three takeaways from the 2024 Star Ratings to consider as MA plans formulate their strategies for better performance in the current measurement year and beyond.

Stay ahead of cut point changes with predictive analytics

Since cut points—the range of scores that determine how well a plan fares in each particular measure—are determined based on overall industry performance, MA plans can’t assume they will stay the same from year to year. Indeed, according to Cotiviti’s analysis, 52% of cut points increased for the 2024 ratings—meaning a plan could earn the exact same score in a particular measure year over year, but earn a lower rating. Meanwhile, 22% of cut points remained the same year over year while only 25% decreased.

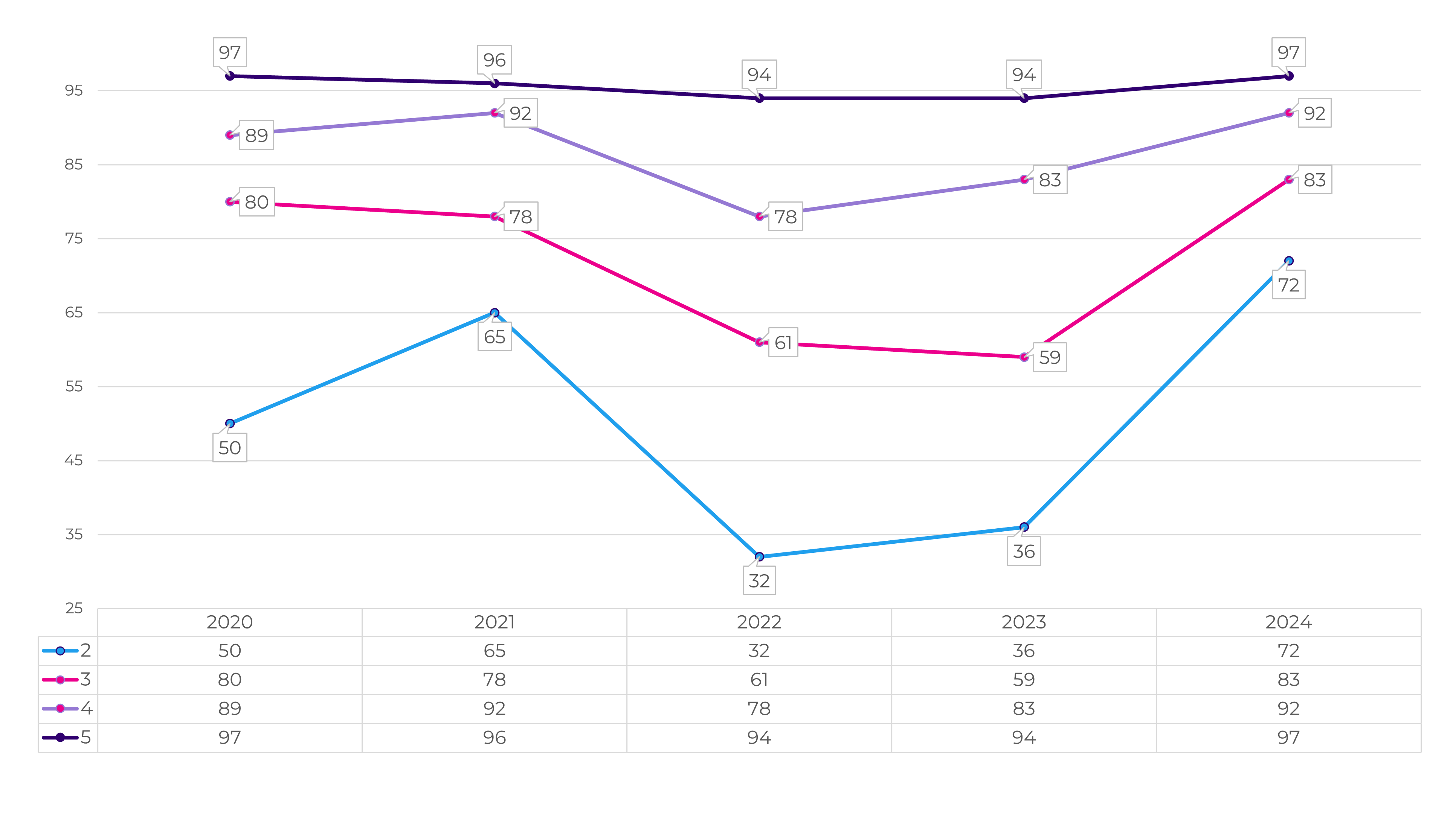

In addition, for several measures, the Tukey outlier deletions significantly narrowed the cut point spread—so a small drop in a particular measure score that would not have impacted a plan’s performance last year could cause the plan to lose half a star in this year’s ratings. Figure 2 demonstrates how the cut point range for one measure significantly narrowed between the 2023 and 2024 ratings.

Figure 2. Cut point range for Call Center – Foreign Language Interpreter and TTY Availability (Part C).

Figure 2. Cut point range for Call Center – Foreign Language Interpreter and TTY Availability (Part C).

Rather than simply guessing, deploying a Star Ratings solution that can predict these cut point shifts can help plans stay on top of these changes by accurately forecasting their own ratings—then taking action to improve them before the current measurement year ends.

In addition, plans must keep ahead of significant changes in measure weights. For example, HEDIS® measures comprised just 13% of the weighting across all Star Ratings measures for the 2023 Star Ratings, but this is projected to increase to 25% by the 2026 ratings. Meanwhile, CAHPS® measures are projected to drop from 32% of overall measure weighting in 2023 to just 20% by 2026.

Integrate quality measurement with member engagement

As it becomes harder to achieve a higher Star Rating, MA plans that use their quality measurement tools for HEDIS and Star Ratings reporting as a “single source of truth” for driving consumer outreach will see greater success. Instead of taking a one-size-fits-all approach to member engagement, plans that build a data repository fed by their quality engine to drive targeted outreach have a higher chance of reaching the right member at the right time with the right message.

With little time remaining in the current measurement year, this approach is vital to reducing wasted efforts and helping ensure that each outreach counts. This approach also has the added benefit of improving the member experience to drive better CAHPS scores in the future.

Foster a culture dedicated to quality improvement

As noted in CMS’s data, among MA-PD plans with 10 or more years of experience in the Star Ratings program, 52.6% earned a rating of four stars or higher—compared with just 27% of plans with less than five years of experience in the program. This demonstrates that strong Star Ratings performance requires continual, long-term investment and a cultural shift so that quality improvement becomes everyone’s responsibility within the health plan.

Take time now to communicate your plan’s performance in the 2024 Star Ratings to your entire organization, analyzing where you did well and determining where targeted investments could lead to improved measure scores in the 2025 Star Ratings and beyond.

It’s hard to overstate the impact of poor performance in the Star Ratings program, with a decrease of half a star potentially reducing quality bonuses by millions of dollars per year for a single MA plan. Conversely, plans that achieve higher ratings have more resources to recruit new members—while five-star plans have the significant advantage of being able to enroll new members year round.

Among Cotiviti Quality and Stars clients, 56% of contracts earned a rating of four stars or higher, compared to just 35% of contracts that use alternative quality solutions.

Read our fact sheet and learn how Cotiviti’s Star Intelligence enables MA plans keep up with competitors by:

- Leveraging analytics that offer measure prediction, EOY predictions, trends, and opportunities for growth

- Accessing a one-stop shop for HEDIS quality and Star Ratings management

- Gaining a clear view of progress with trending and benchmarking dashboards

- Getting reliable insights through predictive cut points built into advanced analytics

HEDIS® is a registered trademark of the National Committee for Quality Assurance (NCQA).

CAHPS® is a registered trademark of the Agency for Healthcare Research and Quality (AHRQ).